Virginia Property Tax Reassessment Overview

ID

AAEC-327NP

What are Reassessments and why are they done?

Tax reassessment is a process jurisdictions undergo to ascertain the current value of real estate. By statute, property values must be assessed periodically to reflect their value on the open market. The reassessment process determines the current market value of properties or parcels within a jurisdiction to which the localities property tax rate will apply. Tax reassessments are essential for proper calculation of real property tax. Real estate taxes are the largest source of revenue for most jurisdictions and thus valuations play a major role in these budgets. For example, in 2023, Fluvanna County collected $27 million in real estate taxes comprising 45% of their revenue (Dahl and Melton, 2023) and Chesterfield county collected $55.9 million comprising 51% of their revenue (Chesterfield County, 2023). Even small changes in real estate values can result in significant tax savings for property owners.

How often are they done?

Reassessments may take place at intervals spanning from one to six years. Per Virginia Code § 58.1-3253 “the governing body of any county or city may, by ordinance duly adopted, provide for the annual assessment and equalization of real estate for local taxation.” Additionally, jurisdictions who employ a full-time real estate appraiser or assessor “may provide by ordinance for the biennial assessment and equalization of real estate.” Since each parcel must be valued individually, reassessment can be a complex process. Thus, jurisdictions may opt for longer reassessment intervals for fiscal and practical reasons. Rules for reassessment intervals differ for cities and counties.

Cities with a population of 30,000 or less have the option to conduct general reassessments at four-year intervals. Cities with a population over 30,000 must reassess every two years (Va. Code § 58.1-3250). Conversely, counties with a population over 50,000 must reassess every four years unless the county’s board of supervisors approves a three-year cycle. Counties with a population 50,000 may elect to conduct their general reassessments at five- or six-year intervals (Va. Code § 58.1-3252). For cities, the most common reassessment interval is annually or every year, whereas the most common interval for counties is six years (Fig. 1). In summary, counties may extend their reassessment cycles up to six years, whereas cities must conduct property reassessment at least every four years.

Who conducts the reassessment?

The reassessment process is overseen by the commissioner of the revenue (“Commissioner”). Reassessments are made by either a professional assessor appointed by the governing body (this may be an employee or independent contractor), or a board of assessors consisting of a minimum of three members, one from each district represented by the elected governing body (Va. Code § 58.1-3275). In 2022, 58% of jurisdictions reported conducting reassessments in-house employees, while 42% utilize an independent contractor (Fig. 2).

Reasons for contracting or completing reassessment in- house

Choosing to contract professional appraisers versus conducting reassessments in-house utilizing employees primarily depends on costs, including considerations of capacity and expertise. For jurisdictions which reassess on frequent intervals, it may be more cost effective to employ a full-time assessor for reassessments. For instance, a majority of cities reassess annually and thus 71% of cities employ a full-time assessor (Fig. 3). Alternatively, jurisdictions which reassess less frequently may opt to contract with an outside appraiser to conduct property assessments. As shown in Figure 1, the most common reassessment interval for counties is every six years. As such, 70% of counties contract out reassessment, whereas only 26% of cities contract out reassessment (Fig. 3). Pearsons Appraisal contracts typically cost anywhere from $25 to $30 per parcel (see Pittsylvania County, Franklin County).

Reassessment Processes

Specific processes for real estate assessments differ between jurisdictions, however reassessment typically begins with grouping neighborhoods into sub-divisions. For instance, residential areas or rural properties might be grouped together based on factors such as acreage, soil quality, square footage, or last assessment value. Next, appraisers analyze sales data for each zone and give a professional assessment of the property value. In Fairfax County, collecting and analyzing sales data takes up to ten months. Then, the sales and real estate data is used to create models for individual subdivisions. Jurisdictions may utilize software such as Cama, Valcre, Sovos, Tyler, or numerous other tax appraisal applications to create these models. The software uses sales and real estate data to produce estimated property values. Lastly, notices are sent out to all landowners of any changes in assessment values. Landowners may appeal to a board of equalization to adjust an assessment of real property which may in turn increase, decrease or affirm the assessment. (Va. Code § 58.1-3381). This appeal equalization process can take anywhere from one to three months and marks the end of the reassessment process.

For jurisdictions who contract out reassessments, the process similarly begins with creating sub-divisions within the county, then collecting sales data and physically inspecting properties if necessary. In cases where a physical inspection isn’t deemed necessary, Geographic Information Systems (“GIS”) software is used to assess aerial imagery of properties for valuation purposes. Then, appraisers also utilize mass-reassessment software to combine sales data and create models for valuations of subdivisions or certain areas.

Physical inspections of specific properties may be completed if requested by a landowner, or if deemed necessary by the jurisdiction. Due to resource and time constraints, physical inspections are not completed for every parcel or every jurisdiction. Approximately 63% of Virginia jurisdictions complete physical inspections during reassessment (Fig. 4).

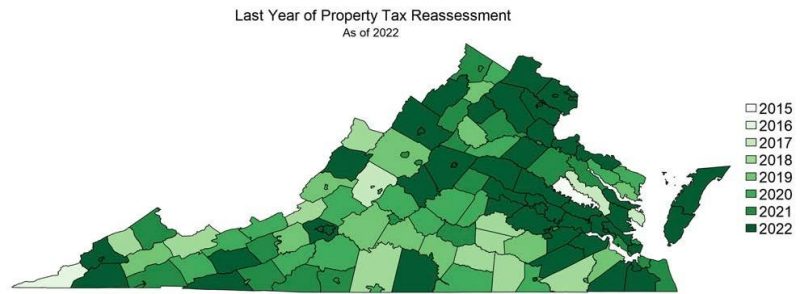

Below, a color-coded map shows the frequency of reassessment cycles in the various jurisdictions in Virginia.

Summary

In conclusion, tax reassessment is a process used by jurisdictions to update the current market value of real estate. Reassessments ensure proper calculation of real property taxes which are a major source of revenue for jurisdictions. Frequency of reassessments differs for counties and cities. Counties with a population over 50,000 must reassess every four years, while counties with a population of 50,000 or less may choose five- or six-year intervals. Cities with a population over 30,000 are required to reassess every two years, while those with a population less than 30,000 are required to reassess every four years. The most common reassessment frequencies are every six years for counties and every one year for cities. The reassessment process is overseen by the commissioner of the revenue, who, alongside the governing body, appoints either a professional appraiser employed by the jurisdiction or an independent contractor to carry out the task. Cost, frequency of reassessments, and jurisdictional capacity are all factors that influence whether the jurisdiction contracts reassessment to an outside source or conducts it in-house. Whether conducted in-house or by an independent contractor, reassessment typically begins with grouping properties into subdivisions then analyzing sales data since the last reassessment. Then, appraisal software creates models for each subdivision based on sales data and real estate information to produce individual property valuations. Last, new reassessment values are published, and landowners are given a 1-2 month period to appeal the valuation before real estate values are finalized. Overall, this comprehensive process ensures the bases for tax estimates remain aligned with current market decisions, with implications for landowners paying taxes and jurisdictions receiving the revenue.

| Cities | Frequency (out of 38 cities) | Percent |

|---|---|---|

| Contracts to outside source | 10 | 26% |

| Completed process In-house | 28 | 74% |

| Employs Full-time assessor | 27 | 71% |

| Physical Inspection Part of Reassessment | 14 | 37% |

Source: Kulp, Virginia Local Tax Rates, 2019

| Counties | Frequency (out of 95 counties) | Percent |

|---|---|---|

| Contracted | 67 | 70% |

| In-house | 28 | 30% |

| Employs full-time assessor | 59 | 62% |

| Physical Inspection Part of Reassessment | 70 | 74% |

Source: Kulp, Virginia Local Tax Rates, 2019

References

Commonwealth of Virginia. 2022. Virginia Code. §§ 58.1-3250, 58.1-3252, 58.1-3253, 58.1-3271. https://law.lis.virginia.gov/vacodefull/title58.1/chapter32/article5/cities.

Chesterfield County, 2023. FY2023 Budget. https://www.chesterfield.gov/DocumentCenter/View/28599/FY2023- Budget-PDF.

Dahl, Eric and Tori Melton. 2023. Fluvanna Annual Comprehensive Financial Report 2023. Fluvanna County. https://www.fluvannacounty.org/sites/default/files/fileattachments/finance_department/page/1431/fluvanna_ac fr_2023_secured.pdf.

Franklin County, 2022. Meeting Minutes 05-2022. Franklin County Agenda Center. https://franklincountyva.gov/AgendaCenter/ViewFile/Minutes/_05172022-323

Kulp, S. C. (2020). Virginia Local Tax Rates, 2019 38th Annual Edition (38th ed.). University of Virginia – Self Published Content. https://online.vitalsource.com/books/97820193820191

Pittsylvania County, 2024. 2024 Reassessment. https://www.pittsylvaniacountyva.gov/government/projects/reassessment

Virginia Cooperative Extension materials are available for public use, reprint, or citation without further permission, provided the use includes credit to the author and to Virginia Cooperative Extension, Virginia Tech, and Virginia State University.

Virginia Cooperative Extension is a partnership of Virginia Tech, Virginia State University, the U.S. Department of Agriculture (USDA), and local governments, and is an equal opportunity employer. For the full non-discrimination statement, please visit ext.vt.edu/accessibility.

Publication Date

June 21, 2024